How Does An Entered Expense Post In The Bank Register In Quickbooks Online

The critical job of entering business expenses helps to continue the account data accurate and bring a significant reduction in taxation liability. Recording or entering concern expenses in the QuickBooks program is no rocket scientific discipline and can be washed with ease by following the Enter Expenses in QuickBooks steps well-explained in this article.

Save Time, Reduce Errors, and Improve Accuracy

Dancing Numbers helps pocket-sized businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

What is Inbound Expenses in QuickBooks?

Speaking in the linguistic communication of QuickBooks, expenses are determined from any kind of transaction that has taken place via debit card, credit card, bank transfer, internet cyberbanking or online payment and must be recorded.

Checking on how your expenses of the concern are being spent and how sufficiently you would be able to manage future costs, explains as the primary reasons for recording expenses on QuickBooks. Adding to the benign aspects, entering expenses on QuickBooks likewise simplifies the process of tax filing thereby bringing profits against cost and offsetting revenue.

How to Tape Expenses on QuickBooks?

The foremost step to get started with entering expenses on QuickBooks is to have an expense account. For creating an expense business relationship on QuickBooks you need to set it up in the allocated chart of accounts.

The process begins with the application'due south "Enter Bills" feature and designating the various business categories under which the corresponding transactions have been made.

This article would guide you lot effectively to sympathise the various steps involved in recording expenses on QuickBooks.

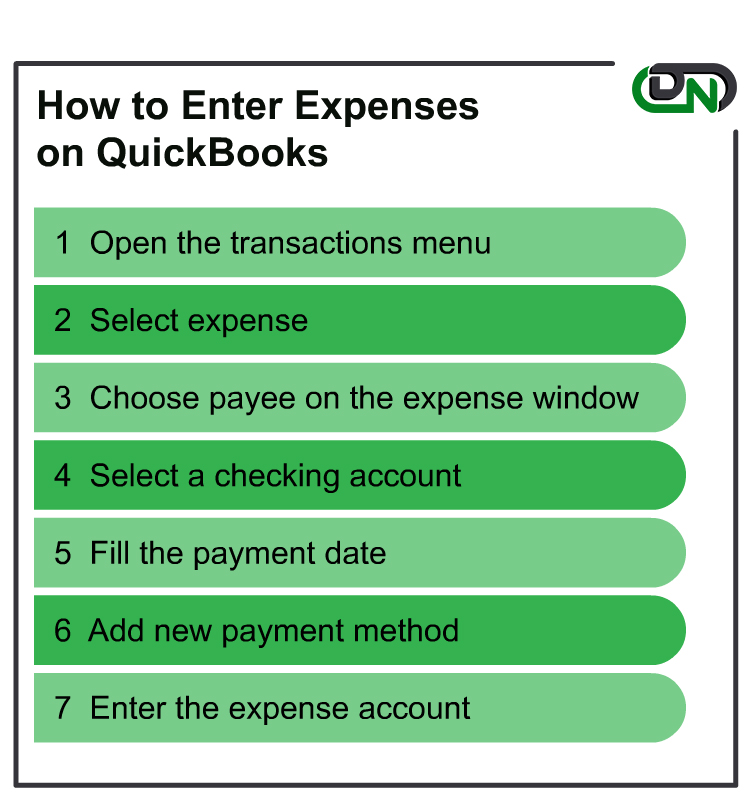

Steps to Enter Expenses in QuickBooks

The offset stride is to have an expenses business relationship, for which you demand to follow the steps below:

Creating an Expense Business relationship:

- Open QuickBooks abode page and notice Chart of Accounts

- Side by side printing on the account and select New which will open up a New Account window

- Select Expense by clicking the business relationship type

- Blazon the proper noun of the account under the Business relationship Proper name Field

Later you have created an expense account successfully, the next steps below would help you to enter expenses on QuickBooks:

Step 1: Open the Transactions Menu

Click on the plus sign (+) icon that will open up the transactions menu page.

Pace 2: Cull Expense

Click Get to Vendors and choose Expense

Step 3: Select Payee on the Expense Window

Select Payee on the Expense window. If the Payee not enlisted under Expenses, you demand to add the name by clicking on Add together (for adding additional details about the Payee, so click on +Details or Save)

Stride 4: Selecting a Checking Business relationship

Select the account under which the buy took place. For debit card transactions, it would be selecting a Checking Account.

Step five: Enter the Payment Date

Enter the Payment Date that would be the appointment of purchase.

Stride 6: Add New Payment Method

For other payment methods, you need to add them past clicking on Add together New

Choose the account category from Account if added or else add together a new ane by clicking on Add together New (for adding further data, type it out in the Description dialogue field.

If you need to attach a PDF file, or a picture, click on Attachments

Step 7: Enter the Expense Account

In the amount field, enter the expense account. Later filling in all the corresponding information, press Save and Shut.

If you demand to kickoff on with a new expense entering afterwards saving the previous one, click Save and New.

Tracking Expenses on QuickBooks

Afterwards creating an Expense Account on QuickBooks, you lot can choose to track them effectively. To track your expenses, you lot need to exist set up before you lot hit Save and New or Salvage and Close.

Tracking Expenses:

- If the billing of the expense is done to a particular customer, you need to type out the name of the customer past choosing Billable. You lot can find Billable expense tracking under the Billable column.

- For checking income vs expenses data of each client, you demand to run an Income by Client Summary report.

- For adding data on the purchased service or production, you may utilize fields in Particular Details.

Editing and Deleting Editing an Expense in QuickBooks

Editing Expenses:

- Cull Expenses from the menu on the left-hand side

- Cull the expense from the Expense Transactions window that you wish to edit

- Afterwards updating the transaction, you demand to click on Salvage and Close

(Note: Editing expenses are subjected to change of data in the customer's invoice)

Deleting Expenses:

- Cull Expenses from the menu on the left-hand side

- Choose the expense from the Expense Transactions window that you lot wish to edit

- Select Expense Details window and press More to click on Delete

- Cull Yes to confirm

Hopefully, this commodity would have satisfactorily guided you lot on how to successfully enter Expenses on QuickBooks. Now enter, manage, edit or delete whatever expense you lot wish on QuickBooks and advance accounts of your business organisation by 2X!

Accounting Professionals, CPA, Enterprises, Owners

Looking for a professional adept to go the right assistance for your problems? Hither, we take a team of professional person and experienced team members to prepare your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are hither at Dancing Numbers available to assist you with all your queries. To fix these queries yous can go far bear on with us via a toll-gratuitous number

+i-347-428-6831 or chat with experts.

Why should I employ QuickBooks for Recording Business organisation Expenses?

Designed with seamless functionalities, QuickBooks is highly regarded as one of the finest accounting software. Managing business expenses on QuickBooks is super easy and can be used at the multi-levels of an organization.

Are Bill and an Expense same on QuickBooks?

No, Bill and Expense are not the same on QuickBooks A expense on QuickBooks denotes a transaction for the purchase of appurtenances or services that was paid off. While a Neb is denoted as a transaction that has been purchased merely to billed for later on.

Tin can I add online Transacted Payments as Expenses on QuickBooks?

Yes. On QuickBooks, any kind of payment including debit card, credit card, depository financial institution transfer and online transactions tin be added to Expenses.

Features of Dancing Numbers for QuickBooks Desktop

Imports

Exports

Deletes

Customization

Supported Entities/Lists

Dancing Numbers supports all QuickBooks entities that are mentioned beneath:-

Customer Transactions

| Invoice |

| Receive Payment |

| Estimate |

| Credit Memo/Render Receipt |

| Sales Receipt |

| Sales Order |

| Statement Charge |

Vendor Transactions

| Bill |

| Bill Payment |

| Purchase Gild |

| Item Receipt |

| Vendor Credit |

Banking Transactions

| Check |

| Journal Entry |

| Deposit |

| Transfer Funds |

| Banking concern Argument |

| Credit Carte du jour Statement |

| Credit Card Accuse |

| Credit Card Credit |

Employee Transaction / List

| Time Tracking |

| Employee Payroll |

| Wage Items |

Others

| Inventory Aligning |

| Inventory Transfer |

| Vehicle Mileage |

Technical Details

Piece of cake Procedure

Bulk import, export, and deletion tin can exist performed with simply i-click. A simplified process ensures that you lot will be able to focus on the cadre piece of work.

Mistake Free

Worried about losing fourth dimension with an error prone software? Our mistake complimentary addition enables you to focus on your work and boost productivity.

On-time Support

Nosotros provide round the clock technical assist with an assurance of resolving whatever bug inside minimum turnaround time.

Pricing

Importer, Exporter & Deleter

*See our Pricing for up to 3 Company Files

$199/- Per Year

Pricing includes coverage for users

- Services Include:

- Unlimited Consign

- Unlimited Import

- Unlimited Delete

Accountant Basic

*See our Pricing for up to x Company Files.

$499/- Per Twelvemonth

Pricing includes coverage for users

- Services Include:

- Importer,Exporter,Deleter

- Unlimited Users

- Unlimited Records

- Upto 10 companies

Accountant Pro

*See our Pricing for up to twenty Visitor Files.

$899/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to 20 companies

Accountant Premium

*See our Pricing for up to 50 Company Files.

$1999/- Per Twelvemonth

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to 50 companies

Dancing Numbers: Case Report

Frequently Asked Questions

How and What all tin I Export in Dancing Numbers?

You need to click "Outset" to Export data From QuickBooks Desktop using Dancing Numbers, and In the export process, y'all demand to select the blazon yous desire to export, like lists, transactions, etc. After that, apply the filters, select the fields, and then do the export.

Yous can export a Chart of Accounts, Customers, Items, and all the bachelor transactions from QuickBooks Desktop.

How tin I Import in Dancing Numbers?

To utilize the service, yous have to open both the software QuickBooks and Dancing Numbers on your system. To import the data, you have to update the Dancing Numbers file and then map the fields and import it.

How can I Delete in Dancing Numbers?

In the Delete process, select the file, lists, or transactions yous want to delete, and so apply the filters on the file and then click on the Delete option.

How tin I import Credit Card charges into QuickBooks Desktop?

First of all, Click the Import (Start) available on the Dwelling Screen. For selecting the file, click on "select your file," Alternatively, you lot tin also click "Browse file" to browse and choose the desired file. You can likewise click on the "View sample file" to go to the Dancing Numbers sample file. And so, gear up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on "next," which shows your file data.

Which file types are supported by Dancing Numbers?

XLS, XLXS, etc., are supported file formats past Dancing Numbers.

What is the pricing range of the Dancing Numbers subscription Program?

Dancing Numbers offers four varieties of plans. The well-nigh popular one is the basic plan and the Auditor basic, the Accountant pro, and Auditor Premium.

How can I contact the customer service of Dancing Numbers if whatsoever issue arises after purchasing?

We provide you support through different channels (E-mail/Chat/Phone) for your bug, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in existent-time. You tin even get the benefits of anytime availability of Premium support for all your issues.

How can I Import Price Level List into QuickBooks Desktop through Dancing Numbers?

Starting time, click the import push on the Domicile Screen. Then click "Select your file" from your organisation. Adjacent, prepare the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; yous just demand to download the Dancing Number Template file.

To review your file data on the preview screen, simply click on "adjacent," which shows your file data.

What are some of the features of Dancing Numbers to be used for QuickBooks Desktop?

Dancing Numbers is SaaS-based software that is piece of cake to integrate with any QuickBooks account. With the help of this software, you tin can import, export, too as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which volition help in saving time and increasing efficiency and productivity. But fill in the data in the relevant fields and apply the appropriate features and it's washed.

Furthermore, using Dancing Numbers saves a lot of your fourth dimension and coin which yous can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

Why should do you modify the Employee status instead of deleting them on QuickBooks?

If yous are unable to see the pick to terminate an employee on your list of active employees on the company payroll, this more often than not implies that they accept some history. Thus, if y'all alter the employee status instead of deleting it on QuickBooks, the contour and pay records remain in your bookkeeping database without any data loss in your tax payments.

Is it possible to use the Direct Connect pick to sync bank transactions and other such details between Bank of America and QuickBooks?

Yes, absolutely. You can utilize the Direct Connect Option by enrolling for the Direct Connect service which volition allow you admission to the small business online banking choice at bankofamerica.com. This feature allows you lot to share bills, payments, information, and much more.

Why should do you alter the Employee status instead of deleting them on QuickBooks?

If you are unable to come across the option to finish an employee on your list of active employees on the company payroll, this more often than not implies that they accept some history. Thus, if you change the employee status instead of deleting it on QuickBooks, the contour and pay records remain in your bookkeeping database without any data loss in your revenue enhancement payments.

What are the diverse kinds of accounts you could access in QuickBooks?

QuickBooks allows yous to admission nigh all types of accounts, including but not limited to savings business relationship, checking account, credit menu accounts, and money market accounts.

Get Support

Majority import, export, and deletion can be performed with just one-click. A simplified procedure ensures that you lot will be able to focus on the core piece of work.

Worried about losing time with an error decumbent software? Our error gratuitous add together-on enables you to focus on your piece of work and boost productivity.

How Does An Entered Expense Post In The Bank Register In Quickbooks Online,

Source: https://www.dancingnumbers.com/how-to-enter-expenses-in-quickbooks/

Posted by: perkinstairse.blogspot.com

0 Response to "How Does An Entered Expense Post In The Bank Register In Quickbooks Online"

Post a Comment